Why the EB5 Immigrant Investor Program Is the Smart Choice for Global Investors

The EB5 Immigrant Investor Program provides a tactical opportunity for global financiers, using not just the prospect of U.S. residency but also an opportunity to contribute to economic development. By directing a minimum financial investment into targeted employment areas, participants can develop work while accessing varied markets such as property and renewable resource. This one-of-a-kind mix of economic chance and social influence increases important inquiries regarding its long-lasting benefits and dangers. What makes the EB5 program especially appealing in today's economic environment? Exploring these dimensions may expose understandings that can affect your financial investment decisions.

Summary of the EB5 Program

The EB5 Immigrant Capitalist Program, developed by the united state government in 1990, gives a pathway for international investors to get irreversible residency in the USA through considerable monetary investment in a certifying service. The program was made to boost the U.S. economy by bring in international funding and developing jobs for American workers. Capitalists must satisfy details requirements to certify, consisting of a minimum investment quantity, which is generally $1 million, or $500,000 in a targeted work location (TEA) where unemployment is high or the populace is low.To take part in the EB5 program, financiers can either spend directly in a brand-new or current service or with a Regional Center, which is an entity that sponsors capital financial investment jobs for EB5 financiers. Investments made through Regional Centers have obtained popularity as a result of their capability to swimming pool funds from several capitalists, thus reducing the specific financial worry while advertising larger-scale projects.One of the vital components of the EB5 program is the work creation requirement. Each investment should lead to the production of at the very least 10 permanent jobs for united state workers within a specified duration, making sure that the program not just advantages financiers however also adds to the total economic growth of the country.As a consequence, the EB5 Immigrant Investor Program has actually come to be an eye-catching option for foreign nationals looking for to buy the united state while simultaneously safeguarding a beneficial immigration end result for themselves and their prompt household.

Path to U.S. Residency

The EB5 Immigrant Financier Program uses a practical pathway to U.S - EB5 Immigrant Investor Program. residency through critical investment in qualifying projects. This program not only promotes the capitalist's long-term residency but additionally prolongs family members addition advantages, permitting immediate relative to share in the benefits of U.S. residency. Recognizing these elements is vital for potential investors looking for to navigate the immigration process properly

Residency Through Financial investment

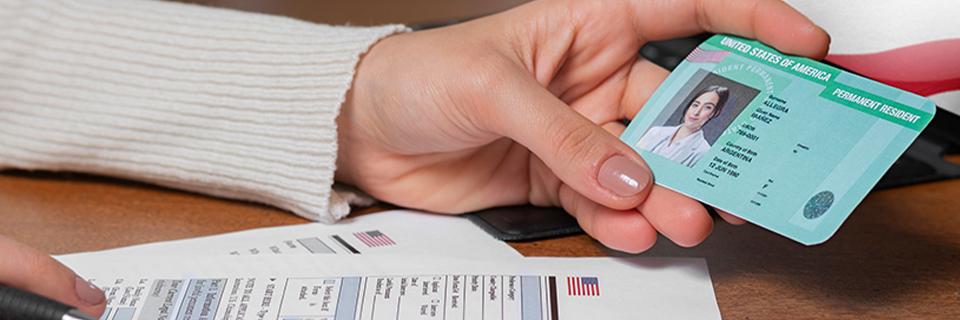

Steering the complexities of U.S. immigration can be daunting, yet the EB5 Immigrant Financier Program uses a clear pathway to residency through investment. This program permits foreign nationals to obtain a united state copyright by spending a minimum of $1 million, or $500,000 in targeted work locations, in a brand-new industrial venture that produces at least ten full time jobs for qualified united state workers.The EB5 program is designed to stimulate the economy with task development and capital expense, making it appealing for those seeking both residency and a return on their investment. When the investment is made and the application is authorized, financiers and their immediate household participants can obtain conditional permanent residency for 2 years - Regional Center Investment.To change to irreversible residency, EB5 financiers need to show that their financial investment has met the work development requirements. This simple procedure, integrated with the potential for financial growth, makes the EB5 program an attractive alternative for international financiers seeking to protect their future in the USA. By choosing this pathway, investors not just obtain residency however additionally accessibility to the various opportunities that feature living in one of the world's most dynamic economic situations

Family Addition Perks

Among the significant benefits of the EB5 Immigrant Financier Program is its stipulation for family members inclusion, enabling financiers to extend residency advantages to their instant family participants. This feature allows a qualifying financier to include their partner and any single youngsters under the age of 21 in their application, creating a pathway for the entire family members to acquire U.S. residency simultaneously.The capacity to consist of household members greatly boosts the program's appeal, as it shows a dedication to family members unity. By safeguarding permanent residency for dependents, the EB5 program gives an one-of-a-kind possibility for families to grow together in the United States, promoting a sense of belonging and stability.Moreover, as soon as provided residency, member of the family can additionally go after instructional and job opportunity without limitations, adding to their individual and professional growth. This domestic incorporation not just enhances the financier's dedication to the U.S. economic situation however likewise strengthens the nation's diversity and social richness. On the whole, the family incorporation advantages of the EB5 program offer as a compelling reward for global capitalists seeking a prosperous future on their own and their enjoyed ones in the United States.

Investment Opportunities Available

The EB5 Immigrant Capitalist Program supplies a selection of investment chances customized to prospective investors. Participants can choose from diverse task choices, consisting of those handled by regional facilities that are especially made to stimulate task development. This concentrate on economic growth not only profits the investors but also adds significantly to the united state economy.

Diverse Task Options

Capitalists looking for to join the EB5 Immigrant Financier Program take advantage of a broad range of job options that cater to different interests and financial objectives. This diversity permits capitalists to straighten their financial investments with personal values, risk resistance, and preferred returns. From property growths to infrastructure tasks, the EB5 program provides opportunities across multiple sectors.Real estate tasks, such as property and business developments, are particularly popular because of their capacity for significant returns and substantial assets. Additionally, capitalists can discover chances in sectors like hospitality, health care, and eco-friendly energy, each offering special benefits and challenges (EB5 Immigrant Investor Program).The adaptability of task option is a crucial benefit for capitalists, as it enables them to pick campaigns that reverberate with their financial investment viewpoint and market understanding (EB5 Immigrant Investor Program). Furthermore, lots of projects are created to boost work creation and economic growth in targeted areas, lining up investor interests with area development.Ultimately, the varied job choices offered via the EB5 program not just broaden the financial investment landscape however also encourage investors to make educated selections that match their monetary ambitions and add favorably to the U.S. economic situation

Regional Center Investments

Regional Facility Investments represent a prominent avenue within the EB5 Immigrant Capitalist Program, supplying capitalists with structured possibilities that frequently yield considerable benefits. Regional Centers are assigned by the United States Citizenship and Migration Provider (USCIS) and concentrate on advertising economic development via work development and funding financial investment. These facilities assist in different projects across diverse industries such as property, friendliness, facilities, and manufacturing.Investors can take part in these chances with a minimal financial investment of $800,000, which is routed toward development tasks that fulfill USCIS standards. One of the key advantages of buying a Regional Facility is the lowered demand for direct work development; financial investments can qualify based upon indirect jobs produced within the more comprehensive economic situation. This flexibility allows financiers to participate in jobs that might not have a straight work connection yet contribute favorably to the local economy.Moreover, Regional Centers usually supply substantial assistance, including project administration and reporting, which can streamline the investment procedure for international nationals. The organized nature of these investments, combined with the potential for lucrative returns, makes Regional Center Investments an enticing choice for international investors seeking residency in the USA.

Task Creation Focus

While navigating via the EB5 Immigrant Financier Program, a main focus continues to be on job development, which functions as an important statistics for examining financial investment opportunities. Capitalists are called for to create or preserve a minimum of ten full-time jobs for U.S. employees, straight linking their capital expense to concrete financial benefits. This need not only fosters neighborhood employment yet likewise promotes regional economies.Investment possibilities under the EB5 Program frequently align with tasks that have a proven record of job production. Regional facilities, designated by the united state Citizenship and Immigration Provider (USCIS), play a vital function by merging investments into bigger jobs, such as commercial growths or infrastructure renovations. These jobs are meticulously made to satisfy job production thresholds while supplying financiers an organized path to irreversible residency.Furthermore, concentrating on sectors like property, friendliness, and renewable resource assurances that investments add to sustainable growth. By selecting the appropriate regional facility and project, investors can optimize their effect on task production while placing themselves favorably within the united state economic situation (EB5 Minimum Capital Requirement). This dual benefit of economic return and social effect makes the EB5 program an appealing investment opportunity for worldwide capitalists

Economic Benefits of EB5

Family Incorporation in Investments

Household inclusion is a vital attribute of the EB5 Immigrant Capitalist Program, allowing financiers to prolong advantages to their prompt member of the family. This stipulation not just boosts the charm of the program however likewise aligns with the worths of household unity and shared chance. Under the EB5 program, capitalists can include their spouse and any kind of unmarried children under the age of 21 in their application. This indicates that the entire family members can get eco-friendly cards, granting them permanent residency in the United States.By consisting of relative in the investment, the EB5 program acknowledges the significance of household support in the immigrant experience. This addition urges family members cohesion, as each member can access the instructional, specialist, and social chances available in the united state Additionally, the capability to transfer as a family can significantly relieve the adjustment and integration procedure, permitting family members to adapt even more seamlessly to their new environment.The program also profits financiers by enhancing the security and protection of their financial investment, as a family that spends together shows a shared dedication to establishing origins in the U.S. This collective method can bring about a more satisfying migration experience, as families can sustain each other in handling the difficulties of moving to a brand-new nation. Generally, the EB5 Immigrant Capitalist Program's concentrate on household inclusion not only draws in capitalists yet likewise strengthens the program's commitment to fostering family members unity and advertising long-lasting financial investment in the U.S. economic climate.

Danger Mitigation Methods

Steering the intricacies Homepage of the EB5 Immigrant Capitalist Program requires a comprehensive understanding of risk reduction methods to protect investments and ensure effective end results. As with any kind of financial investment, EB5 participants face numerous dangers, including economic, functional, and regulatory unpredictabilities. Efficient threat mitigation is important for safeguarding capitalist resources and achieving the program's designated benefits.One basic method is conducting complete due persistance on the Regional Center and particular tasks in which investors are taking into consideration involvement. This includes assessing the track document, credibility, and monetary health and wellness of the Regional Center, as well as assessing project feasibility and potential for job production. Financiers must seek transparency regarding project timelines, financial forecasts, and leave strategies.Diversification is one more critical approach. By spreading investments across multiple jobs or Regional Centers, financiers can lower direct exposure to any kind of single factor of failing. This not just reduces risk however likewise improves the possibility for returns through different investment channels.Additionally, engaging seasoned legal and financial advisors can provide indispensable insights into maneuvering the intricacies of the EB5 program. Specialists can assist in determining prospective dangers, guaranteeing compliance with governing needs, and structuring financial investments effectively.Lastly, capitalists need to remain notified about adjustments in migration policies and economic conditions that can impact the EB5 landscape. Regular surveillance of these variables enables prompt modifications to financial investment methods, consequently enhancing general safety and security and success in the program. Inevitably, an aggressive and enlightened technique to take the chance of mitigation is vital for EB5 financiers looking for to protect their economic future.

Success Stories of Investors

Successful navigation of the EB5 Immigrant Financier Program is often highlighted via the experiences of capitalists who have actually efficiently handled dangers and attained their goals. One noteworthy success story entails a Chinese business owner that purchased a regional center concentrated on sustainable power. By conducting comprehensive due persistance, he not just secured his family members's residency in the USA but also played a pivotal duty in the advancement of lasting projects that gathered area support and created significant job creation.Another compelling story originates from an Indian financier that founded a tech startup in Silicon Valley after efficiently getting his EB5 visa. His financial investment promoted the facility of a firm that eventually drew in additional financing and created over 150 tasks within three years. This not just allowed him to meet the program's demands yet likewise allowed him to add to the ingenious landscape of the U.S. economy.Moreover, an investor from Brazil leveraged the EB5 program to go into the realty market in Florida. By buying a deluxe condo job, he not just met his visa requirements however likewise saw substantial appreciation in building worth, bring about both monetary gain and chances for his children's education in the U.S.These success tales underscore the capacity of the EB5 program for investors seeking to attain migration goals while adding to the U.S. economic situation. By meticulously choosing tasks and engaging in proactive threat monitoring, financiers have transformed their desires into fact, setting a precedent for future individuals in the program.

Often Asked Questions

What Are the Application Handling Times for the EB5 Program?

Application handling times for the EB5 program typically vary from 18 to 24 months. These times can vary based on a number of variables, consisting of the quantity of applications and certain local facility involvement.

Can I Buy My Own Organization Through the EB5 Program?

Yes, you can invest in your very own business with the EB-5 program, gave it meets the required criteria, including job development requirements and compliance with regulative requirements set by the USA Citizenship and Immigration Solutions.

Exist Any Type Of Age Restrictions for EB5 Financiers?

There are no specific age restrictions for EB-5 investors. Both adults and minors can take part, given they meet the investment needs. Minors should have a legal guardian or representative to handle the financial investment process.

Just how Does the EB5 Program Influence My Tax Obligation Obligations?

The EB5 program can impact tax responsibilities by potentially subjecting investors to united state tax on around the world earnings, depending upon residency status (EB5 Immigrant Investor Program). It is a good idea to speak with tax obligation specialists for personalized support on implications details to private scenarios

What Occurs if My EB5 Application Is Refuted?

If your EB5 application is refuted, you might lose your investment and may not obtain a refund. It is necessary to understand the factors for denial and check out choices for charm or reapplication.